Renters Insurance in and around Baltimore

Looking for renters insurance in Baltimore?

Rent wisely with insurance from State Farm

Would you like to create a personalized renters quote?

There’s No Place Like Home

Your rented house is home. Since that is where you kick your feet up and make memories, it can be a wise idea to make sure you have renters insurance, whether or not your landlord requires it. Even for stuff like your lamps, exercise equipment, microwave, etc., choosing the right coverage can insure your precious valuables.

Looking for renters insurance in Baltimore?

Rent wisely with insurance from State Farm

Why Renters In Baltimore Choose State Farm

Many renters underestimate the cost of refurnishing a damaged property. Your valuables in your rented home include a wide variety of things like your smartphone, bed, microwave, and more. That's why renters insurance can be such a good idea. But don't worry, State Farm agent Eve Hamper has the efficiency and personal attention needed to help you evaluate your risks and help you protect your belongings.

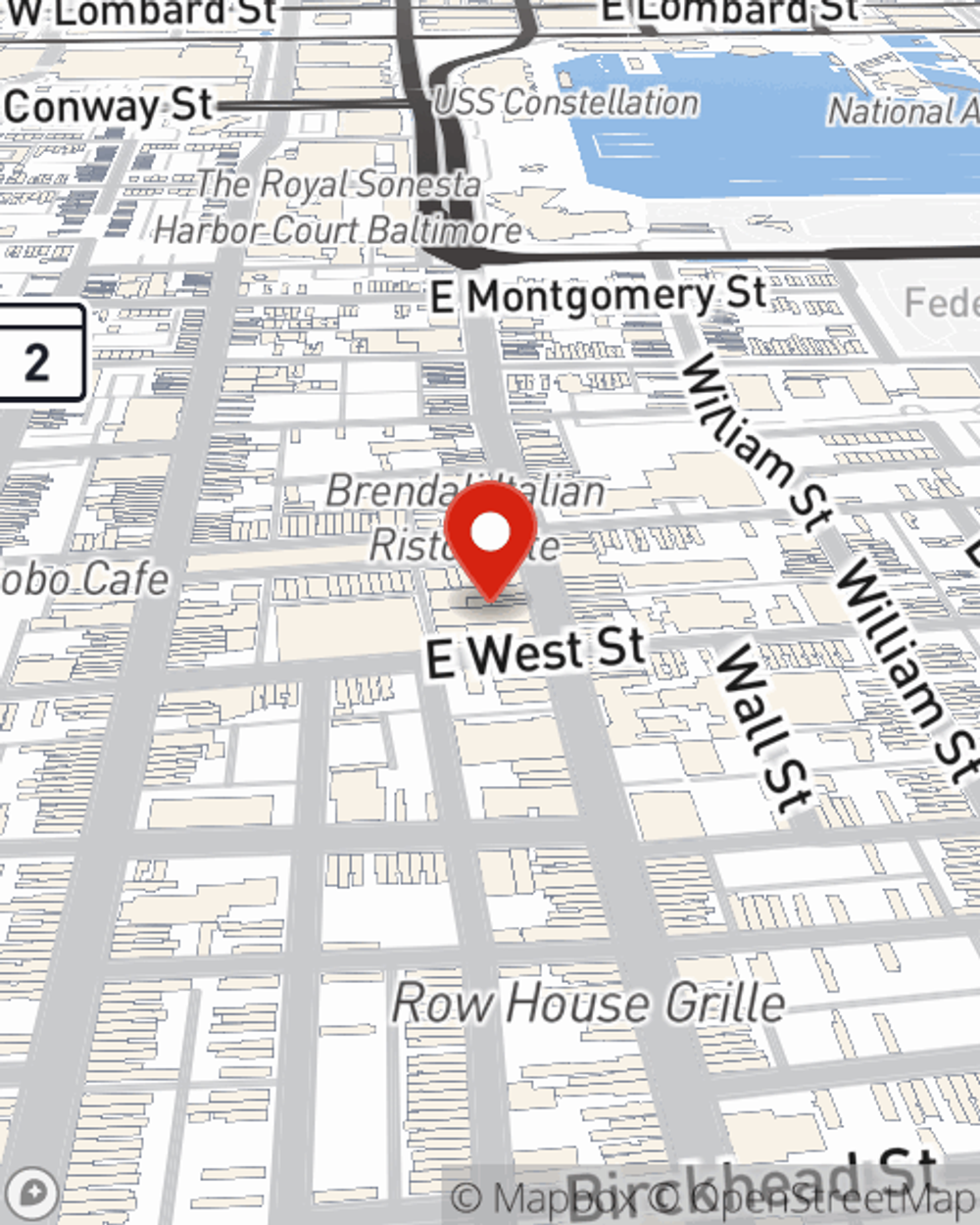

Renters of Baltimore, call or email Eve Hamper's office to identify your personalized options and how you can save with State Farm renters insurance.

Have More Questions About Renters Insurance?

Call Eve at (410) 528-8900 or visit our FAQ page.

Simple Insights®

What you need to know about replacement cost vs market value

What you need to know about replacement cost vs market value

Learn the difference between replacement cost value and market value coverage to make an informed decision when purchasing home insurance.

What to do after a house fire

What to do after a house fire

Consider these tips to help you and your family recover after a house fire.

Simple Insights®

What you need to know about replacement cost vs market value

What you need to know about replacement cost vs market value

Learn the difference between replacement cost value and market value coverage to make an informed decision when purchasing home insurance.

What to do after a house fire

What to do after a house fire

Consider these tips to help you and your family recover after a house fire.